Here’s How EPA Should Set Buy Clean Standards For Steel

This blog was written jointly with Anish Tilak (RMI), Sravan Chalasani (RMI), and Mike Williams (Center for American Progress).

The Inflation Reduction Act contains billions in direct investments to decarbonize U.S. industrial manufacturing and pilot procurement of low-carbon steel, concrete, and other widely used construction materials across key federal agencies under the umbrella of Buy Clean: an ambitious Biden administration strategy to use the purchasing power of the government to reduce the climate footprint of infrastructure projects and strengthen U.S. industry. The new climate law tasks the U.S. Environmental Protection Agency (EPA) with developing first-ever climate performance standards for Buy Clean across priority materials categories, defining what constitutes as “clean” for federally funded public works projects.

To be effective, Buy Clean programs must encourage near-term emissions reductions while creating a longer-term pathway to deep decarbonization (emissions cuts of 70 percent or greater, all the way to zero-emission or near-zero-emission industrial manufacturing) across key domestic industrial manufacturing sectors. This is especially critical in the steel sector, where carbon intensity varies significantly based on the method of steel production.

Designed well, Buy Clean for steel can accelerate decarbonization, serving as a major incentive for clean, globally competitive manufacturing and high-quality jobs. Designed poorly, Buy Clean could create a baseline for broadly adopted standards that would drive segments of the domestic steel manufacturing industry out of business without lowering the overall emissions intensity of the industry. To thread this needle, the EPA must design policies in such a way as to avoid simply leaking emissions abroad and other unintended consequences that may inadvertently hurt climate goals. This will require the agency to take a flexible approach that is responsive to the current state of the steel industry while evolving over time in alignment with industry transformation.

Steel manufacturing today

In today’s industry, steelmaking is a mix of primary manufacturing (from ore) and recycling. In primary steelmaking, iron ore is processed using an integrated blast furnace/basic oxygen furnace (BF/BOF) system, or in a direct-reduced iron (DRI) plant. In a BF, coke (a fuel derived from coal) is burned to chemically reduce iron ores at temperatures of up to 1,300 degrees Celsius. Carbon dioxide (CO2) is emitted both in heating the ore and in chemical reactions with it. In DRI, a reducing gas (e.g., hydrogen) reacts at lower temperatures with iron ore to make sponge iron, which can then be briquetted and used in an electric arc furnace (EAF).

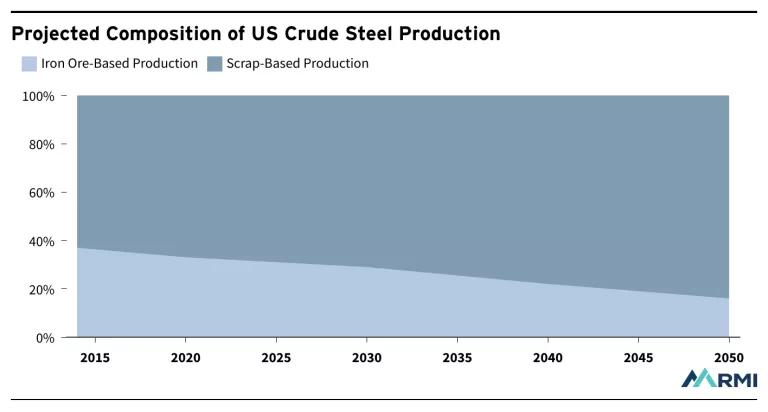

In secondary steelmaking, an EAF is used to melt existing steel, primarily steel scrap, and recycle it into a new steel product. This uses less energy per ton of steel and results in substantially fewer emissions compared to the BF/BOF route, but it is limited by the supply of DRI products and steel scrap. While more than 70 percent of steel is produced globally using the BF/BOF route and about 30 percent of steel is DRI/EAF or scrap/EAF, the ratio is roughly the inverse in the United States, where EAF facilities dominate the industry.

Critically, EAF steelmaking does require non-scrap inputs in the form of pig iron (BF) or sponge iron (DRI) to achieve the desired chemical composition of the steel. The amount of iron in production at EAFs varies. The sourcing of pig iron can be problematic, as companies recently had to grapple with supplies coming from Russia and Ukraine. Setting aside the horrific nature of the Russian invasion of Ukraine, the production of iron in these two countries often rates as the dirtiest in the world. In contrast, most DRI has been produced domestically in the United States or imported from nearby (e.g., Trinidad and Tobago). The EPA must take special care to understand the full impact of the inputs into steelmaking and in setting initial standards.

Steel recycling can help mitigate emissions, especially if the EAFs used to melt steel scrap run on zero-carbon electricity. However, it is not possible to supply the world’s steel needs using the EAF route alone because EAFs do not make new steel, but rather melt existing steel to make new products. While scrap steel can meet growing steel demand to an extent, U.S. domestic primary steel production will still be a key component of steel industry in 2050. Decarbonizing the U.S. steel industry thus requires credible pathways to slash emissions from primary steelmaking (DRI or BOF).

The role of Buy Clean standards in steel decarbonization

For the reasons outlined above, U.S. primary steel producers are key partners in this effort, as investments in decarbonizing primary steel production are necessary to achieve national climate goals. However, poorly designed Buy Clean standards risk shifting demand away from the BF/BOF production route in the short term, compromising the primary steelmakers’ ability to invest in decarbonization while not meaningfully changing the GHG emissions profile of the U.S. steel industry.

Take the example of hollow structural steel sections. Hollow structural sections are made with steel slabs. These slabs can be made using the BF/BOF or the EAF route. The emissions intensity of these products will depend on the share of primary metal and scrap metal in those products, yet it bears repeating that not the entire demand for structural steel products can be met with EAFs. Nearly all hollow structural steel products made via the BOF process, however, will have higher emissions than those made via EAFs.

Early Buy Clean emissions standards for steel products are being set based on a percentile of the industry average emissions reported in environmental product declarations (EPDs) for a product category, such as hollow structural steel sections. In the near term, these product-based standards should be set in such a way as to avoid driving demand away from primary steelmaking facilities, but at the same time begin to push BOF facilities to adopt best-practice emissions reduction strategies. The EPA should prevent bifurcation of product category (PCR) rule development in the steel industry by manufacturing process, which could reduce comparability of EPDs in the future.

However, as the EPA tightens Buy Clean emissions standards over time, it will become increasingly difficult for primary steelmakers to compete head-to-head with EAF-made steel. One unintended consequence could be that BOF manufacturers increase the ratio of scrap steel in their products (up to a practical limit of roughly 30 percent) without fundamentally shifting production practices at the BOF steel facility. Another could be that buyers move to purchase exclusively from EAF facilities, reducing business at BOF facilities at a time when critical decarbonization investments are needed. Both scenarios would lead to simple reshuffling of emissions without significant decarbonization in the sector. Avoiding this will require the EPA to adopt a dynamic approach to setting Buy Clean emissions standards for steel, based on more accurate reporting of recycled content in EPDs.

A proposed approach to setting Buy Clean standards

One way to approach setting emissions standards for steel products is to use the share of primary and scrap steel in the final product in conjunction with the separate decarbonization trajectories for each. Consider again the case of the hollow structural steel sections. Internal analysis conducted by RMI shows that hollow steel section products made domestically in the United States are comprised of roughly 50 percent scrap steel on average—a ratio that is expected to shift over time. Assume you are trying to set a standard for hollow steel sections for the year 2030. According to the International Energy Agency’s Net Zero Emissions by 2050 Scenario, the emissions intensity for primary steelmaking in 2030 is 1.8 tCO2/t of steel and 0.3 tCO2/t of steel for scrap-based secondary steelmaking.

Rather than setting a static emissions intensity standard, the EPA could adjust standards for products with higher or lower recycled content. For example, for a hollow structural section with 60 percent scrap steel content, the emissions intensity standard could be 0.9 tCO2/t of steel (1.8 x 40 percent + 0.3 x 60 percent). For hollow steel sections with a higher scrap content, the standard could be lower. If the reported emissions intensity for the hollow section includes emissions from fabrication processes, an average emissions intensity value for fabricating the steel can be added to the calculated standard of 0.9 tCO2/t of steel. This ensures that the reported data and the calculated standard are both easily comparable.

As the EPA develops Buy Clean standards for procurement of steel, it should, from the outset, prioritize transparency around the recycled scrap content in specific steel products (e.g., rebar, plate steel) as a reported parameter in EPDs, as well as the sourcing of key raw material inputs such as pig iron. To ensure standardization across EPDs, the agency should work with Product Category Rule (PCR) program operators in the steel industry to determine a standardized approach for including recycled content as a reported parameter in EPDs. In the nearest term, targets can be set using estimated average recycled content in steel product types.

Once actual recycled content and raw material input reporting become standard practice, emissions standards for the steel industry can be set using a sliding scale that accounts for either the fraction of primary and secondary steel or separate targets for these component parts. The EPA should signal its intent to proceed flexibly and adjust standards in a manner that is responsive to changes in the industry over time.

In the long run, to achieve deep decarbonization and ultimately near-zero emissions by mid-century, primary steel makers—which are currently using the BF/BOF process—must undertake significant decarbonization efforts. Buy Clean standards should incentivize and help accelerate the adoption of key decarbonization technologies. The EPA should continuously review targets over time to account for shifts in the industry. Eventually, as emissions intensities converge, it may be appropriate for the EPA to establish a single embodied emissions standard for steel products purchased under Buy Clean, regardless of the ratio of primary to scrap steel.

Steel decarbonization pathways

There are multiple potential pathways for zeroing out emissions from primary steelmaking. One is by replacing a BOF with an EAF powered by zero-carbon electricity, and replacing a BF with DRI via a process that runs on 100 percent hydrogen. To the extent that the hydrogen is “green”—i.e., that it is produced from water in a process powered by 100 percent (or nearly 100 percent) renewable electricity—the process would result in virtually emissions-free steel. Scaling this technology remains a big challenge, in large part because of the necessary renewables build-out. However, cultivating a domestic green steel industry could be a boon for the U.S. economy and a source of good-quality jobs. The economic benefits of such reindustrialization are especially pronounced, considering the United States is currently the world’s largest steel importer. And with incentives in the Inflation Reduction Act, the United States now has the potential to produce the world’s most competitive low- and zero-carbon steel.

Buy Clean and other federal procurement policies must have a line of sight toward incentivizing this transformation in the U.S. steel sector, while mitigating near-term leakage risks. Given the urgency, it will be imperative for the federal government to invest directly in this transition. Recognizing this, Congress made available a historic $6 billion in industrial decarbonization grants via the U.S. Department of Energy to decarbonize heavy industrial facilities, including retrofitting or replacing blast furnaces with low-carbon primary steelmaking technology, alongside other federal programs aimed at speeding this industry transition. For their part, American steel producers must urgently focus on reducing emissions over multiple time horizons—short-, medium-, and long-term—and adopt deep decarbonization technologies for primary steelmaking.